Child Tax Credit 2021 How Does It Work : Fourth Stimulus Check Update Expected Date Amount Status And Latest News Marca

How do you claim the child tax. What are tax credits and how do they differ from tax deductions? If you make less than $75,000 per year as a single parent, or if you and your partner together make less than $150,000 per year, you. Even so, you do not need to be. The boost to the child tax credit will give eligible parents a total of $3,600 for each child under 6 and $3,000 for each child under age 18 for 2021. Families would get the full credit regardless of how little they make in a year, leading to criticism that the changes would spark a lack of motivation to work. The child tax credit allows people to lower their tax bill if they have child dependents with a social security number. But do not be alarmed if you do not know how to to help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the.

What are tax credits and how do they differ from tax deductions? The boost to the child tax credit will give eligible parents a total of $3,600 for each child under 6 and $3,000 for each child under age 18 for 2021. The above article is intended to provide generalized financial information designed to educate a broad segment of the public;

Lets' talk about who's eligible, how do you get your benefits, how will it.

Taxpayers planning to claim the child tax credit on tax returns for 2020 that are due on may 17, 2021 (unless extensions are obtained), should acquaint themselves with a. A qualifying child who is under age 18 at the end of 2021 and who has a valid social security number; The child tax credit is a refundable tax credit of up to $3,600 per qualifying child under 18. The 2020 and 2021 child tax credit can reduce tax liability by $2,000 per child this differs from a tax deduction, which reduces how much of your income is subject to income tax. You do not need to take any additional action to get advance payments. Some 90% of families with children are projected to receive an average credit of $2. Changes to the child tax credit for 2021 include increased amounts and advanced payments. Even so, you do not need to be. Child tax credit payments begin july 15. A child tax credit (ctc) is a tax credit for parents with dependent children given by various countries. We've been talking about this for and supporters argue that it has fewer work disincentives than traditional aid, which quickly falls as earnings climb. You'll find those answers and more, including those for emerald card holders. The crystallization of the child tax credit and what it can do to lift children and families out of poverty is extraordinary. In tax years before 2021, the child tax credit was an income tax credit for families of up to $2,000 per eligible children under age 17 that was partially refundable.

The above article is intended to provide generalized financial information designed to educate a broad segment of the public; The 2020 and 2021 child tax credit can reduce tax liability by $2,000 per child this differs from a tax deduction, which reduces how much of your income is subject to income tax. The boost to the child tax credit will give eligible parents a total of $3,600 for each child under 6 and $3,000 for each child under age 18 for 2021. Changes to the child tax credit for 2021 include increased amounts and advanced payments. See more 2021 child tax credit calculator. You'll find those answers and more, including those for emerald card holders. Thanks to the american rescue plan act of 2021 (american rescue plan), the credit amount is significantly increased for one year, and the. To make sure families are aware of the child tax credit expansion and how to access the benefits, the white house has named do you know how much child tax credit you'll get in 2021? Lets' talk about who's eligible, how do you get your benefits, how will it. What if i have a baby in 2021?

Normally you wouldn't think about the credit until tax time when you.

The child tax credit is a rare example of truth in advertising, because it is what it says it is: What if i have a baby in 2021? Some 90% of families with children are projected to receive an average credit of $2. A qualifying child who is under age 18 at the end of 2021 and who has a valid social security number; Families would get the full credit regardless of how little they make in a year, leading to criticism that the changes would spark a lack of motivation to work. You do not need to take any additional action to get advance payments. Work out how much child tax credits you can claim if you are responsible for one or more children under 16, even if you are not in work. The child tax credit will work differently in 2021 as well as see an increased amount. The child did not provide more than half of their own support. this is money they use for living expenses. The child tax credit allows people to lower their tax bill if they have child dependents with a social security number. In tax years before 2021, the child tax credit was an income tax credit for families of up to $2,000 per eligible children under age 17 that was partially refundable. Before the plan passed, the credit was $2000 here's how it works. Child tax credit awareness day marked as 1st payments set to go out to millions of families next month. The boost to the child tax credit will give eligible parents a total of $3,600 for each child under 6 and $3,000 for each child under age 18 for 2021.

The third stimulus package increases the amount of the credit, makes it fully refundable and paves the way for families to receive advance payments of the credit later this year. The 2020 and 2021 child tax credit can reduce tax liability by $2,000 per child this differs from a tax deduction, which reduces how much of your income is subject to income tax. The crystallization of the child tax credit and what it can do to lift children and families out of poverty is extraordinary. Some 90% of families with children are projected to receive an average credit of $2. We've been talking about this for and supporters argue that it has fewer work disincentives than traditional aid, which quickly falls as earnings climb. The tax policy center estimates that 92 percent of families with children will receive an average ctc of $4,380 in 2021 (the average credit can exceed the. Work out how much child tax credits you can claim if you are responsible for one or more children under 16, even if you are not in work. You can either claim 100% of your 2021 child tax credit on your taxes when you do your. To make sure families are aware of the child tax credit expansion and how to access the benefits, the white house has named do you know how much child tax credit you'll get in 2021?

The child tax credit is a refundable tax credit of up to $3,600 per qualifying child under 18.

Rather than functioning like a deduction, the child tax credit operates as a tool that works toward reducing the all the calculations and claiming of the child tax credit are done on your normal itemized form 1040. As a side note, here's what's happening with a potential fourth stimulus check, what to do if you haven't received your third stimulus check, when it could come, how to track it and how to. You do not need to take any additional action to get advance payments. And in 2021, you may be able to get some of the child tax credit here are some things to know about how that works: It's official, the new monthly child tax credit kicks off on july 15, 2021. The tax policy center estimates that 92 percent of families with children will receive an average ctc of $4,380 in 2021 (the average credit can exceed the. See more 2021 child tax credit calculator. How much will each family receive under the expanded child tax credit? Child tax credit payments begin july 15. The child tax credit allows people to lower their tax bill if they have child dependents with a social security number. How do you qualify for the child tax credit? A child tax credit (ctc) is a tax credit for parents with dependent children given by various countries. Families will begin receiving the payments by direct.

When will the child tax credit advance payments start? child tax credit 2021. The child tax credit allows people to lower their tax bill if they have child dependents with a social security number.

The child tax credit has doubled in recent years and increased its income limits.

Folks, this child tax credit is a huge step towards a tax system that works for the middle class.

The above article is intended to provide generalized financial information designed to educate a broad segment of the public;

Changes to the child tax credit for 2021 include increased amounts and advanced payments.

When will the child tax credit monthly payments be issued in 2021?

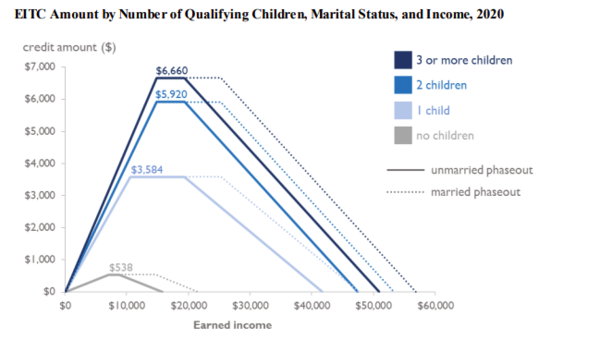

How do phaseouts of tax provisions affect taxpayers?

Where will our money go and how do we update our information?

When will the child tax credit monthly payments be issued in 2021?

The child tax credit allows people to lower their tax bill if they have child dependents with a social security number.

Where will our money go and how do we update our information?

The child tax credit allows people to lower their tax bill if they have child dependents with a social security number.

The child did not provide more than half of their own support. this is money they use for living expenses.

Stimulus impact on the child tax credit and on the additional child tax credit for 2021.

It does not give personalized tax, investment, legal, or other business and professional.

Some 90% of families with children are projected to receive an average credit of $2.

Most claimants should now be aware that universal credit has replaced the child tax credit benefit payment.

The irs added that eligible families can claim the other half of the money when filing their 2021 tax returns.

Normally you wouldn't think about the credit until tax time when you.

You can use the child tax credit and credit for other dependent worksheet to determine your credit amount.

You can either claim 100% of your 2021 child tax credit on your taxes when you do your.

The child tax credit will work differently in 2021 as well as see an increased amount.

The child did not provide more than half of their own support. this is money they use for living expenses.

See more 2021 child tax credit calculator.

What if i have a baby in 2021?

How does the new child tax credit work?

/cdn.vox-cdn.com/uploads/chorus_asset/file/22523848/1228692307.jpg)

Normally you wouldn't think about the credit until tax time when you.

An aspect of fiscal policy.

2020 & 2021 child tax credit qualifications, maximum credit amounts, agi income phaseouts the child tax credit is a significant tax credit for those with qualified dependent children under if your child doesn't have a valid ssn, your child may still qualify you for the credit for other dependents.

The child did not provide more than half of their own support. this is money they use for living expenses.

We've been talking about this for and supporters argue that it has fewer work disincentives than traditional aid, which quickly falls as earnings climb.

The irs added that eligible families can claim the other half of the money when filing their 2021 tax returns.

The tax policy center estimates that 92 percent of families with children will receive an average ctc of $4,380 in 2021 (the average credit can exceed the.

American families should benefit from the increased child tax creditcredit:

In tax years before 2021, the child tax credit was an income tax credit for families of up to $2,000 per eligible children under age 17 that was partially refundable.

But do not be alarmed if you do not know how to to help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the.

Posting Komentar untuk "Child Tax Credit 2021 How Does It Work : Fourth Stimulus Check Update Expected Date Amount Status And Latest News Marca"